Amazon has become one of the top platforms for ecommerce sellers over the past few years.

The company has greatly expanded seller services in an effort to attract sellers from other platforms, and it has new special tools that make it much easier for sellers to track and manage their taxes. In this special report, we’ll explain everything you need to know about Amazon and taxes, so stay tuned to learn all about Amazon Sales Tax.

Amazon and Taxes

Nearly every online purchase comes with taxes these days, and sellers who don’t collect and pay taxes can land themselves in legal trouble. Thankfully, major platforms make it easier for sellers to handle local sales taxes.

Amazon’s automatic collection makes the sales tax process a lot easier on sellers, but that’s not the end of your tax responsibilities. You also need to pay regular taxes on your income from the platform.

Here’s how the sales tax process works on Amazon:

- Whenever a customer makes a purchase, Amazon automatically calculates the necessary sales tax based on the customer’s location and the nature of the product being sold. This calculation occurs in real-time during the checkout process.

- After collecting sales tax from the customer, Amazon manages the funds in a separate account distinct from the seller’s account till it is time to remit the collected taxes.

- Amazon swiftly takes charge of remittance by initiating the process of paying the appropriate authorities as per the decided sales tax schedule. The guidelines and frequency of this process varies greatly depending on the specific state’s taxation policies, which Amazon adheres to strictly.

- Additionally, Amazon provides detailed reports to sellers, outlining all the transactions, along with the collected sales tax. This comprehensive documentation aids sellers in their financial and tax record practices, ensuring accuracy and compliance with tax laws.

- Lastly, if Amazon has a warehouse or any other form of business presence in a particular state, they comply with the state’s sales tax laws and collect tax accordingly. This is otherwise known as nexus tax laws and varies according to each state’s taxation guidelines.

Amazon Sellers Income Tax

When you make money on Amazon, you have to pay taxes on it. US taxpayers are responsible for paying income tax on their earnings, and Amazon’s income is no exception. Your Amazon earnings will be calculated on your personal tax return, and your tax rate will depend on your tax bracket.

You have to pay taxes on your income, but that doesn’t necessarily mean you will receive a Form 1099 from Amazon. The IRS looks at Amazon as a payment processor, so it doesn’t have to issue 1099 forms for every dollar earned on its platform. Instead, Amazon only issues a 1099-K Form for sellers with more than $20,000 in sales and 200+ transactions on the platform.

Many smaller sellers won’t meet the 1099-K form threshold, but that doesn’t mean you’re off the hook for income taxes. You still need to accurately declare and pay taxes on your income, or you could face penalties and fines from the IRS. Don’t assume you don’t need to file if you haven’t received a 1099-K form.

Sales Tax Nexus and Amazon

A ‘sales tax nexus’ may seem complex, but in simple terms, it’s the link your business has with a state due to specific conducted activities. If a state considers one of your business activities as creating a nexus, you need to collect and remit sales taxes for that state.

Surprisingly, what constitutes nexus can differ between states. For instance, having a brick-and-mortar store in Illinois, an office in Texas, and a warehouse in New Jersey, binds your business to those specific states, creating a sales tax nexus.

Moving to Amazon, a mistake made by many is the assumption that Amazon only collects sales tax on sales they execute directly. Due to the Marketplace Facilitator laws, Amazon also collects sales tax on behalf of third-party retailers in certain states. This ruling means that sellers in every state can now sell items on Amazon without paying their state directly.

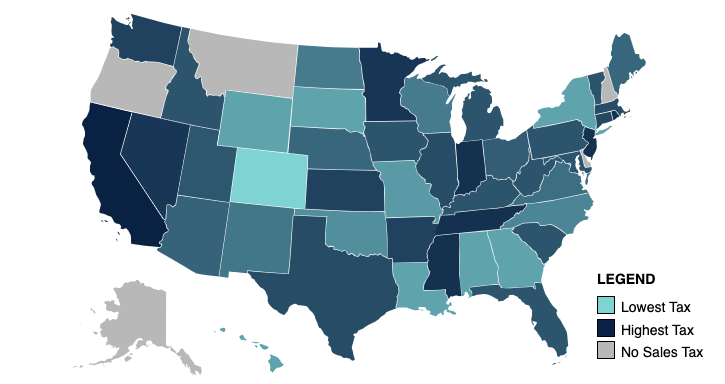

You can refer to Government sites like Tax-Rates.org to explore the standard statewide sales tax for every state. Notably, some states like California, Indiana, New Jersey, and Rhode Island have tax rates of 7% or more. In contrast, states like North Carolina, Alabama, Virginia, and Colorado have tax rates of 4% or less.

Each transaction automatically includes the correct rate for the respective state, with the buyer covering the tax calculated by Amazon. This means you don’t have to stress about the tax; it’s taken care of when you sell products.

Self-Employment Taxes

If you’re a professional marketplace seller on Amazon, you probably need to pay self-employment taxes on your gross sales from Amazon. Anyone who earns more than $1,000 on the platform is responsible for paying self-employment taxes, regardless of whether or not you receive a 1099-K form.

Self-employment taxes typically cost 15.3% of your total income, and the same goes for Amazon. These taxes cover the cost of Social Security and Medicare taxes, which would be taken out of your paycheck if you were a W2 employee. However, since you get paid directly from Amazon with no payroll taxes deducted from your checks, you have to pay self-employment taxes to cover the employee and employer portion of these taxes.

Online businesses with earnings greater than $1,000 should declare their Amazon earnings on their personal tax returns if the business operates through a sole proprietorship or pass-through entity.

Sales Tax Exemptions

Amazon’s Tax Exemption Program (ATEP) is available for certain types of qualifying businesses, and the option creates some additional considerations for your online selling business. ATEP allows sellers to give Amazon permission to automatically handle sales tax exemptions for buyers through their seller account.

States offer sales tax exemptions for a wide variety of reasons, but some examples of common sales tax-exempt organizations include charities, religious organizations, and schools.

If your organization falls into one of these categories, you could qualify for a sales tax exemption in your state.

As a remote seller, you could run into complications if your buyers fall into the tax-exempt category.

Amazon’s ATEP system makes compliance much more certain. The platform’s automatic handling also includes the collection of buyer exemption documentation on a per-order basis, ensuring that each transaction is verified as sales tax exempt.

You can elect to participate in the program through your Amazon Tax Settings dashboard.

Tax Exemption Codes for Amazon

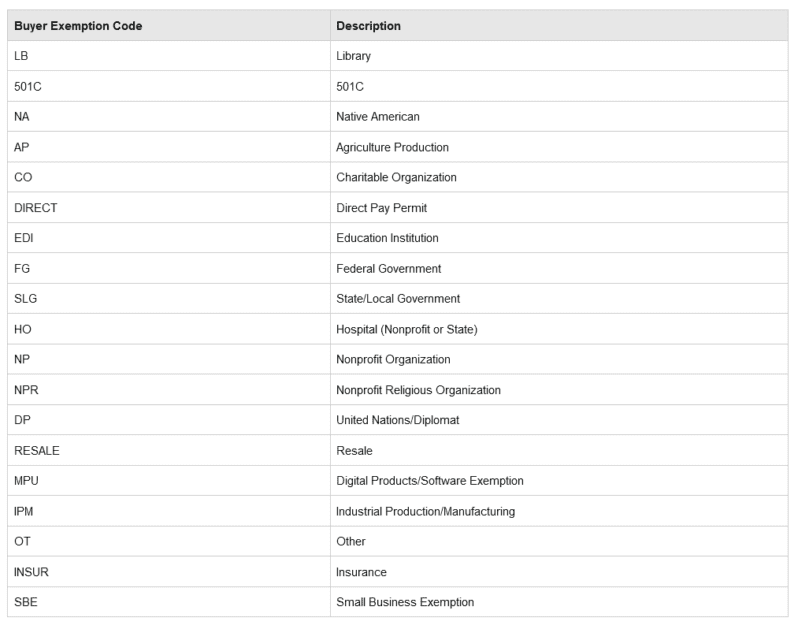

If you’ve sold to tax-exempt buyers in the past, you might be wondering about those codes listed on your sales tax report.

Each code represents a different classification of businesses that qualify for sales tax exemptions on their orders. Knowing what these codes mean could lead you to additional insights into your sales numbers and customer demographics.

You can use this table showing every Amazon Buyer Exemption code and its corresponding designation to decipher the labels you see on your report:

As you can see, there are many types of organizations that can qualify for tax-exempt status on Amazon. Many organizations in these categories could have large spending budgets that could make them excellent customers for your business, so it’s worth keeping an eye out for these codes.

As you can see, there are many types of organizations that can qualify for tax-exempt status on Amazon. Many organizations in these categories could have large spending budgets that could make them excellent customers for your business, so it’s worth keeping an eye out for these codes.

Common Tax Deductions

Small business owners can reduce their overall tax obligation by tracking and declaring their business expenses. You can deduct these costs from your adjusted gross income to reduce your taxable Amazon seller income.

An Amazon seller or Amazon FBA seller can usually write off expenses like these:

- Advertising

- Home office expenses

- Merchandise

- Contractors

- Office supplies

- Transaction fees

- Shipping costs

- Software

- Internet

- and more

You can report these deductions when you login to file taxes at the end of the year. Your goods sold will remain the same, but the deductions can greatly reduce your taxable profit.

Audits and Penalties for Non-Compliance

It’s important to mention that you seriously don’t want to mess with Amazon when it comes to sales tax.

Imagine you’re an Amazon seller who’s been a little lax with sales tax. All of a sudden, you’re being audited. Sounds scary, doesn’t it?

Audits usually pop up when a state spots something fishy or when your reported earnings don’t match up with your sales. In an audit, the state takes a close look at everything – your bank statements, sales receipts, and invoices.

Let’s be honest, nobody likes being audited. It’s stressful and pretty intense. The state can even ask to see your financials going back years, even up to a decade.

If it seems that you’ve deliberately or carelessly skipped out on sales tax, the consequences can be serious. Penalties vary by state, but you’re looking at hefty fines and interest on the unpaid sum. And in some extreme situations, criminal charges.

But before you panic, remember that this is a wake-up call about the importance of following Amazon Sales Tax rules. Stay on top of it and your business can steer clear of audits.

International Sales and VAT on Amazon

If you’re directing your products or services toward international markets on Amazon, it’s crucial to grasp the concept of VAT (Value Added Tax). While sales tax is the chief concern for sellers within the United States, VAT is the equivalent for transactions within the European Union. The current standard VAT rate varies across the EU, but it generally ranges between 17% and 27%.

Moving on, Amazon provides a VAT Calculation Service. This tool calculates the VAT customers need to pay, on your behalf, based on the information you provide in your VAT settings. It’s designed to ease your international trade processes, keeping your business compliant and taking one of the many taxing tasks off your hand. But, like all tools, it relies on the accuracy of the input you provide.

Now you might be wondering, “how does Amazon collect VAT?” Here’s the deal – once you’ve registered for VAT in the countries where you hold inventory, you’re required to charge VAT on your sales. Amazon does not automatically collect VAT on your behalf unless you on the “VAT Calculation Services” in your settings. This feature, when enabled, automatically applies VAT to your product listings and issues VAT invoices on your behalf.

Tips for Managing Amazon Sales Tax

Navigating the maze of Amazon sales tax can be a daunting task, especially when you’re selling across multiple states. Each state has its own rules and rates, subjecting your business to different tax parameters. So, how can one simplify this seemingly complex realm?

First, it’s critical to understand your Nexus, essentially where you have a physical presence, as it dictates where you’re required to collect sales tax. Multiple factors, including your physical location, warehouse, employee presence, and where your goods are stored, can establish a Nexus. Now, let’s break down some best practices on managing Amazon sales tax effectively:

- Automate Tax Calculations: Given the variability in tax rates across different states, manual calculations can leave room for potential errors. Investing in quality sales tax software can automate these calculations, saving you both time and headache.

- Register for a Sales Tax Permit: Before collecting any sales tax, you’ll need to register for a sales tax permit in the respective states where you have a Nexus. Remember, collecting sales tax without a permit is illegal in many jurisdictions.

- Frequently Review Your Nexus: The factors that establish a Nexus can change over time. A new employee location or additional warehouse can create a Nexus in a new state. Therefore, it’s advisable to periodically reassess your Nexus and make necessary amendments to your tax collection setup.

- Stay Informed: Tax laws are not static; they change periodically. Keeping an eye on the latest tax bills and amendments can help you stay compliant and avoid any unforeseen fiscal penalties.

Handling Amazon sales tax doesn’t have to be an uphill battle. With the right understanding and tools at your disposal, you’ll be well-equipped to manage any tax-related complexities that arise, all while staying fully compliant with state laws. It’s all about being proactive, understanding your obligations and leveraging available resources to make tax collection a breeze.

FAQs

Taxes are Part of Every Business – Even Ecommerce

Whether you’re trying to stay on top of Amazon sales tax, or considering their implications for your online sales and business model, one thing is certain – you can’t escape them. If tax season makes your head spin, you’re not alone. The team of professionals at TaxHack is offering Ecommerce CEO readers a complimentary strategy session to ensure you’re compliant with all local, state, and federal tax laws while growing your online sales.